Top 7 online food delivery trends in 2022 to get ideas for business development

Read the article to learn how to engage customers and gain a competitive advantage in the current landscape.

To earn a profit, a digital marketplace platform has to attract customers, deliver an engaging shopping experience, as well as generate a large volume of sales. It is also important to prevent user churn and other potential issues. With these aims in view, companies have to monitor a range of online marketplace metrics, from the number of unique users to gross merchandise value and lifetime value.

By continuously tracking marketplace performance indicators, organizations become able to measure business success, improve budget planning, and identify aspects that require additional effort. Furthermore, it is possible to make more informed decisions and launch personalized advertising campaigns.

This article describes the main marketplace metrics that platform owners need to analyze. But first, let’s have a look at the classification of marketplace KPIs.

In order to measure marketplace success, it is crucial to take into account a variety of KPIs. Marketplace performance indicators are divided into the following categories:

Now, we will describe the core online marketplace metrics that you should track to enhance user experience and increase revenue.

By tracking monthly active users (MAU), marketplace operators can define the number of people who have visited an app or website at least once within a specified period. If this figure remains the same or increases very slowly, this means that a company does not attract new customers or existing clients do not come back. Reasons for this situation can be different.

For instance, a website may not provide the necessary goods, or online payments do not work, or shoppers have to wait for hours until their requests are answered, or an organization does not invest in marketplace promotion.

It is worth noting that businesses can also monitor the number of daily users and overall marketplace visits that include people who have interacted with the platform more than once during 30 days.

Bounce rate (BR) is an online marketplace metric that represents the percentage of single-page sessions—lasting 0 seconds—to the total number of visits. In fact, bounce rate showcases the percentage of users who enter a website and immediately exit without making any actions, for example, clicking on a link. Typically, a high BR starts with 56%, an average BR ranges between 41%–55%, and a good BR is 10%–40%, according to Semrush.

Since not engaged customers are not likely to continue using a digital marketplace platform, a company should strive to make a bounce rate as low as possible. If this metric is not so high as necessary, an organization has to identify and address existing issues. For instance, web pages can load over 10 seconds or a design of web pages may look outdated.

The average session duration shows the time spent by a user on a marketplace application. By tracking this online marketplace metric, it is possible to determine the level of customer engagement. Considering websites in general, a good session length varies between 2–3 minutes.

A net promoter score (NPS) is among the key marketplace performance indicators demonstrating the willingness of customers to recommend the platform to their friends, family, or colleagues. To obtain an NPS, a company asks the following question: "How likely is it that you would advise an e-marketplace?" Users, in their turn, estimate the service from 0 to 10.

As a consequence, an organization can segment the audience into three categories:

Hence, the more customers are engaged with an online marketplace business, the higher volume of sales will be generated through the platform. As a result, marketplace owners will manage to maximize their revenues. If an NPS is too low, it is important to collect user feedback and identify issues that have to be resolved. For instance, consumers may be dissatisfied with shipping services or insufficient payment options.

A conversion is any desired action that a company wants a customer to take, from making a purchase to registering on a digital marketplace platform. Simply put, the conversion rate represents the number of conversions divided by the number of unique marketplace visitors within a certain period. Businesses generally have numerous conversion goals, which helps them evaluate the performance of marketplace applications.

Thanks to this, it is possible to monitor what percentage of users have done certain activities when interacting with an e-marketplace and improve lead generation. This way, an organization can earn higher profits from the same amount of traffic.

However, a good conversion rate varies across different industries. Invesp reports that the average conversion rate of web e-commerce platforms is 2.86%. In the US, the average e-commerce website conversion rate accounts for 2.63% in comparison with the worldwide rate of 4.31%.

Churn rate, also known as attrition rate, is another vital online marketplace metric that companies should track. By monitoring customer churn rate, marketplace businesses define the proportion of users that have discontinued using the app, for example, by closing their personal accounts or not visiting a website for more than a year.

Liquidity is a marketplace KPI that showcases the number of transactions carried out via the platform. In order to earn a profit, an e-marketplace requires a critical transaction number and sales amount, as well as a balance of vendors and consumers. Say, if a single provider has to serve 50,000 on a monthly basis but a marketplace has 10,000 MAU, a seller will not manage to generate sufficient revenue.

Therefore, the income of an online marketplace business will be rather low. With the view of preventing this issue, it is crucial to attract clients and merchants while maintaining a balance between them.

In this regard, there are two types of this metric, namely customer liquidity and seller liquidity. Consumer liquidity is the percentage of app visitors who have made a payment. Basically, if this score is more than 30%, this means that a company is rather prosperous.

Vendor liquidity is the percentage of listings that have resulted in successful transactions performed during a specified period. On marketplaces such as Airbnb and Booking.com, liquidity—the percentage of apartment/room reservations—is measured daily. When operating a food delivery service like Uber Eats, this metric should be evaluated hourly.

Gross merchandise volume (GMV) is among the principal marketplace metrics representing the total sales value of goods or services ordered via the platform over a certain period. By tracking this KPI, a company can evaluate the actual growth of the online marketplace business.

With GMV, an organization can get an understanding of:

However, GMV does not show you the revenue earned through the app or website. To calculate it, a company has to multiply the GMV by a take rate, which is a commission paid for each transaction, fees, or/and other marketplace monetization strategies.

Customer acquisition cost (CAC) is about the cost that an organization spends to attract a new client. Apart from marketing and sales expenditures, this price includes additional expenses, such as delivery, user support 24/7, and platform maintenance. The best thing is when CAC is close to zero, which means that a company does not make efforts to increase the audience, which is growing organically.

Customer lifetime value (CLV) is among the top-priority marketplace KPIs that implies the total amount of money a consumer is expected to spend with a company during the whole period of their relationship.

By calculating the CLV, an online marketplace business can find out:

Thanks to this, an organization can improve sales and marketing processes, as well as fulfill customer demand in the best possible way. When measuring CLV, it is important to remember that CLV has to be more than CAC for achieving marketplace success.

To monitor the main online marketplace metrics, a company can employ data analytics solutions, for instance, Mixpanel or Woopra, both providing third-party APIs. With Mixpanel, an organization is able to track user behavior in real time, identify purchasing habits, and determine reasons for churn.

Furthermore, Mixpanel can enable marketplace businesses to segment the audience and see what groups of clients have the highest conversion rate. It is worth remarking that Mixpanel can also let you visualize feature stickiness.

Woopra is another data analytics tool that allows sales and marketing managers to take real-time insights into user behavior, tracing their activities from the first interaction with a two-sided marketplace platform. In addition, Woopra can generate customer retention reports.

Learn more about marketplace API software that you can integrate, from online payments to order and inventory management.

If you want to create a marketplace or extend the existing one, drop us a message. Our software experts will get back to you within 1 business day and help address all issues. Project consultation is free of charge.

Read the article to learn how to engage customers and gain a competitive advantage in the current landscape.

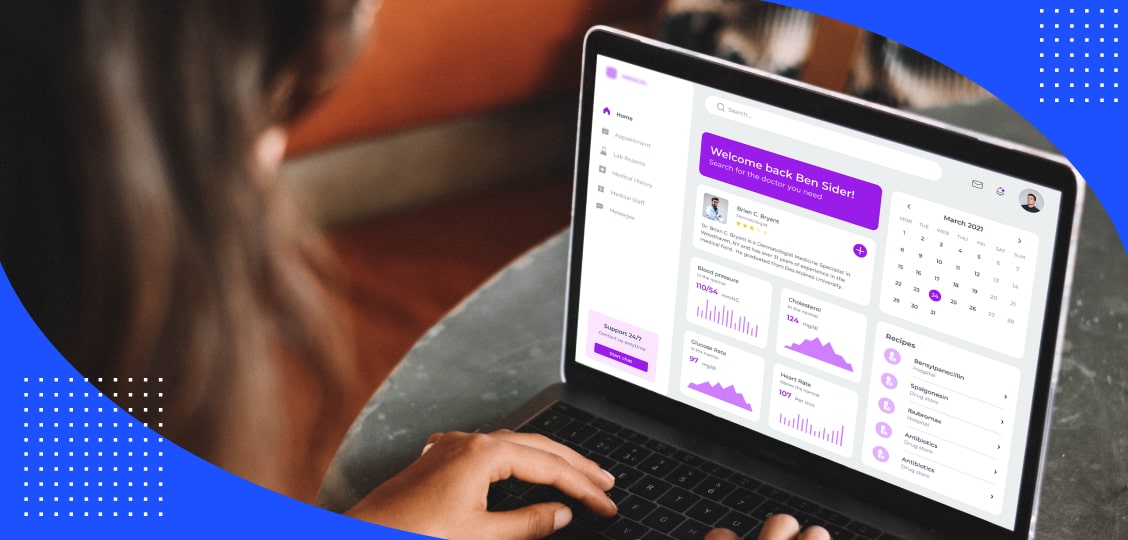

How do you make a healthcare app like Zocdoc and how much does it cost? What budget should you have? Read the article to find out the answers.

Now, you will receive a fresh newsletter from us.

Get the latest scoop on software application tips, announcements, and updates from us. Subscribe to our newsletter!