Choosing a payment gateway for an e-marketplace platform

1.

Study payment methods

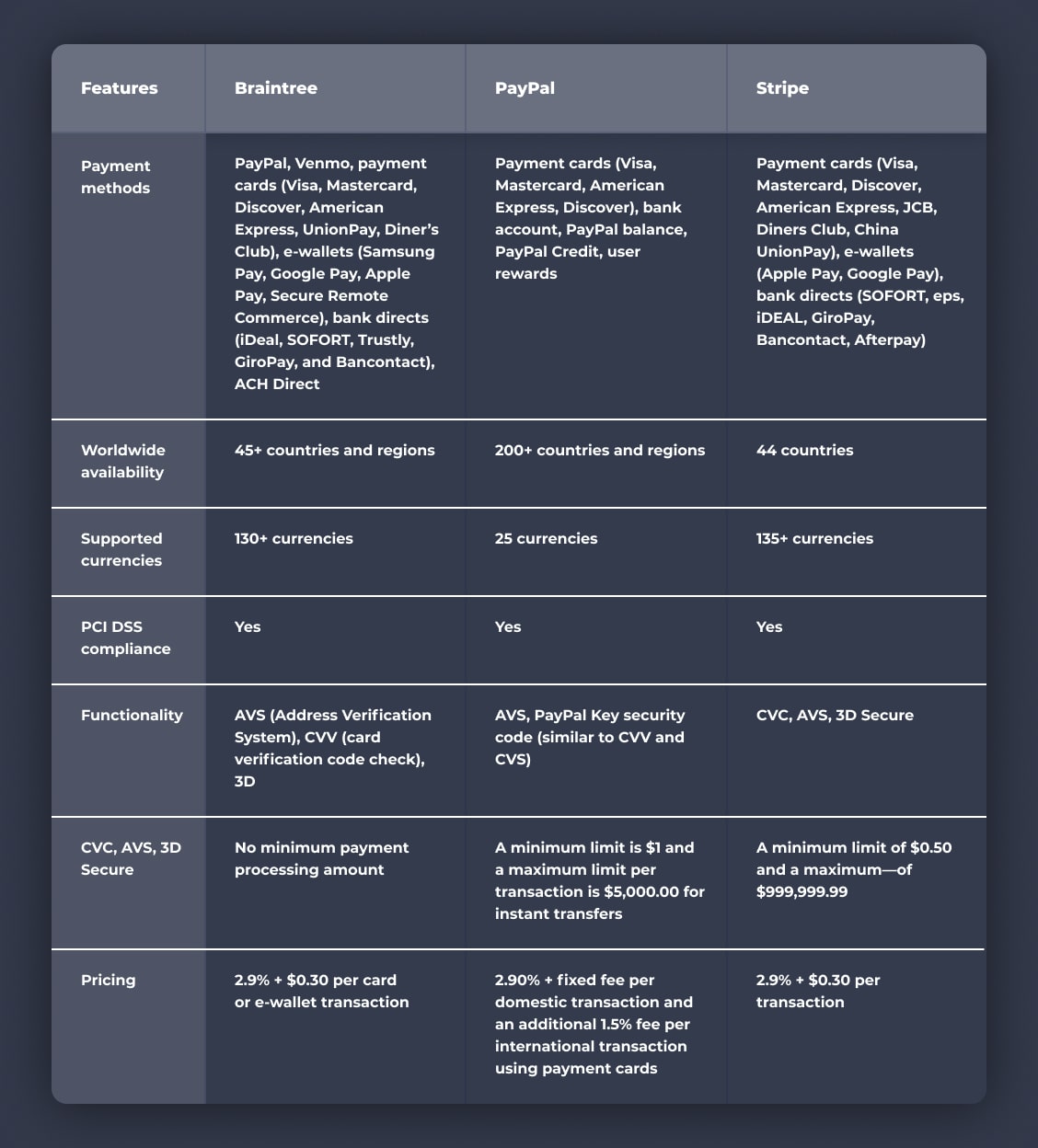

When choosing a payment gateway system, make sure that it supports

payment options used by the target audience. For instance, Braintree

enables customers to make purchases employing the majority of credit

and debit cards that involve Visa, Mastercard, Discover, American

Express, UnionPay, and Diner’s Club. Braintree supports digital

wallets that include Samsung Pay, Google Pay, Apple Pay, and Secure

Remote Commerce.

With Braintree, an online marketplace platform can accept payments

via PayPal, the world’s leading gateway. The main difference between

them is that Braintree offers individual merchant accounts while

PayPal serves as a third-party processor employing a single account.

By integrating PayPal, businesses allow users to shop online using

their bank accounts, credit and debit cards, PayPal balance, PayPal

Credit (for purchases starting from $99), as well as rewards like

cash back and points collected from stores.

Stripe is another popular solution that makes it possible to use a

variety of payment cards (Visa, Mastercard, American Express, JCB,

Discover, China UnionPay, etc.) and mobile wallets (Google Pay,

Apple Pay).

When looking for the best payment gateway for an e-marketplace,

you should also consider whether it accepts transactions via local

payment methods such as iDeal, SOFORT, Trustly, eps, GiroPay,

Bancontact.

In addition, you should take into account changing customer needs.

Statista

informs

that 82% of US consumers preferred to use credit and debit cards

when shopping online in 2019 while 80% of the survey’s participants

from Europe named payment services — involving PayPal and Alipay — as

their favorite options.

In 2020, electronic and mobile wallets became the most widespread

method,

accounting for

44.5% of the global e-commerce sales, according to FIS. By 2024,

these expenditures are projected to reach 51.7%.

Analysts report that credit cards amounted to 22.8% of e-commerce

transactions while debit cards — 12.3%. The popularity of payment

cards is expected to remain almost the same, decreasing to 20.8%

and 12% respectively. Therefore, you should enable these payment

methods when building a marketplace application.

2.

Consider countries supported by a payment gateway solution

Before choosing a payment gateway system, it is essential to verify

that it supports the necessary locations. If you want to build an

e-marketplace platform serving millions of customers globally, you

should consider PayPal, which is available in over 200 countries

and regions.

Stripe, Braintree, and other popular gateways also provide the

possibility to serve users worldwide but with more geographic

limitations. For instance, Germany, Argentina, Panama, Africa,

Belarus, Ukraine, and Israel don’t accept Stripe. At the moment,

Stripe allows for carrying out digital transactions in 44 countries.

To use Braintree, an organization has to operate and have a bank

account in the USA, Canada, Australia, Europe, Malaysia, Hong Kong

SAR China, New Zealand, or Singapore. Subject to these conditions,

a marketplace application will accept payments from any part of the

world. As of today, Braintree supports more than 45 countries and

regions.

3.

Check out the transaction limits of a payment gateway provider

To integrate a payment gateway that will meet business-specific

needs and budget, you should take into account transaction limits

set by a solution provider. Stripe, for example, has a minimum limit

of $0.50 and a maximum — of $999,999.99.

A maximum value will satisfy the requirements of most vendors,

probably excluding companies that trade real estate and luxury cars

online. Considering a minimum amount, it may not suit your needs if

you aim to build an e-marketplace selling goods that cost less than

$0.50.

In case a user account is verified, PayPal has no limits on the

amount of money sent by a customer. However, a user can transfer up

to $60,000 or less in a single digital transaction depending on the

currency.

Regarding instant transfers, a minimum limit is $1 while a maximum

limit per transaction is $5,000.00. It is worth noting that Braintree

doesn’t have a minimum payment processing amount, which is especially

convenient for businesses delivering low-priced products.

4.

Take into account prices of payment gateway providers

Payment gateway solutions undertake various responsibilities — from

transaction processing to verification of banking details — requiring

a fee in return. Commissions are generally charged according to

factors such as location and money transfer amount.

When choosing a payment gateway for a marketplace, it is essential

to study the terms of use and pricing. Payment gateway providers may

charge organizations for system installation, service utilization

per certain period, merchant account setup, as well as ask a fee for

each transaction.

Concerning practical examples, Braintree offers a standard price of

2.9% + $0.30 per card or e-wallet transaction. This plan includes

access to system functionality and support team.

Unlike many other services, the Braintree payment gateway doesn’t

require monthly fees. Furthermore, you can contact experts at

Braintree and ask to adjust pricing to the specific needs of vendors

operating on an e-marketplace platform.

Transaction rates of PayPal are divided into domestic and international

transfers. For instance, the company has a set limit for domestic

online commercial transactions of 2.90% + fixed fee and for

international transactions — an amount of 1.5%.

To employ Stripe, you have to pay a 2.9% + $0.30 per successful

electronic transaction. Stripe can also customize pricing taking

into account your business requirements.

5.

Make sure a marketplace payment gateway is compliant with PCI DSS

Launched in 2006, the Payment Card Industry Data Security Standard

(PCI DSS) strives to ensure that organizations — that store, transmit,

or accept credit card data — safeguard sensitive information. The

primary objective of the PCI DSS is to achieve the safety of payment

accounts throughout transaction processing.

To meet the requirements, companies have to set up reliable passwords,

encrypt data, employ anti-virus programs, restrict data access,

maintain access logs, regularly scan networks for vulnerabilities,

and more.

Hence, it is crucial to make sure that a payment gateway solution is

compliant with PCI DSS before integrating with an online marketplace

platform. Stripe, PayPal, and Braintree are all certified PCI Service

Providers.